AUSTIN, Texas — Over the last two years, Texans have seen double-digit rate increases for home and auto insurance. It’s a problem homeowners and drivers are facing across the United States, especially in Texas. Now Texas lawmakers are looking for solutions.

Texas House Speaker Dade Phelan and Lt. Gov. Dan Patrick – who leads the Texas Senate – each directed members of their chambers to look into the rising cost of premiums ahead of the 89th Legislative Session, which starts Jan. 14.

Many experts say it’s a complicated problem with no easy answer. However, consumer advocates call it a crisis largely of the insurance industry’s own making. Texans stuck paying these high bills say something must change.

In the two decades Greg Banta has lived in a house near Round Rock, he’s seen his rent grow alongside the neighborhood’s property taxes, and recently, his insurance costs too.

Banta says his total premiums, which include renters’ insurance, a jet ski, and his paid-off 2002 Jeep, have jumped roughly 35% in the last year, from around $140 a month to about $190 a month.

“No tickets, no accidents, no claims, no nothing,” said Banta. “I was shocked. I was like, ‘What’s going on?’ if there was a mistake.”

Banta asked an insurance agent about changing coverage.

“It only changed it like five or six bucks here or there, and before you know it, you might as well leave it where it is because you’re not really gaining anything,” said Banta.

Banta says those growing bills, plus pricier groceries, gas, and utilities, mean a growing hurdle to owning his own home.

“You just get hit with everything,” he said.

Many other Texans are also feeling the hit, including homeowners.

On KVUE’s Facebook page, one woman wrote, “Our home insurance went from 2,400 to 4,895.00 with no claims ever. Switched policies still high but saved 1,500 by switching.”

Another woman wrote, “Yes…no tickets ever and costs keep rising…homeowners is now ¾ of my house payment ($4,600 w/no claims) which is causing me to evaluate whether I can stay or not.”

Experts say inflation and extreme weather are two of the biggest factors.

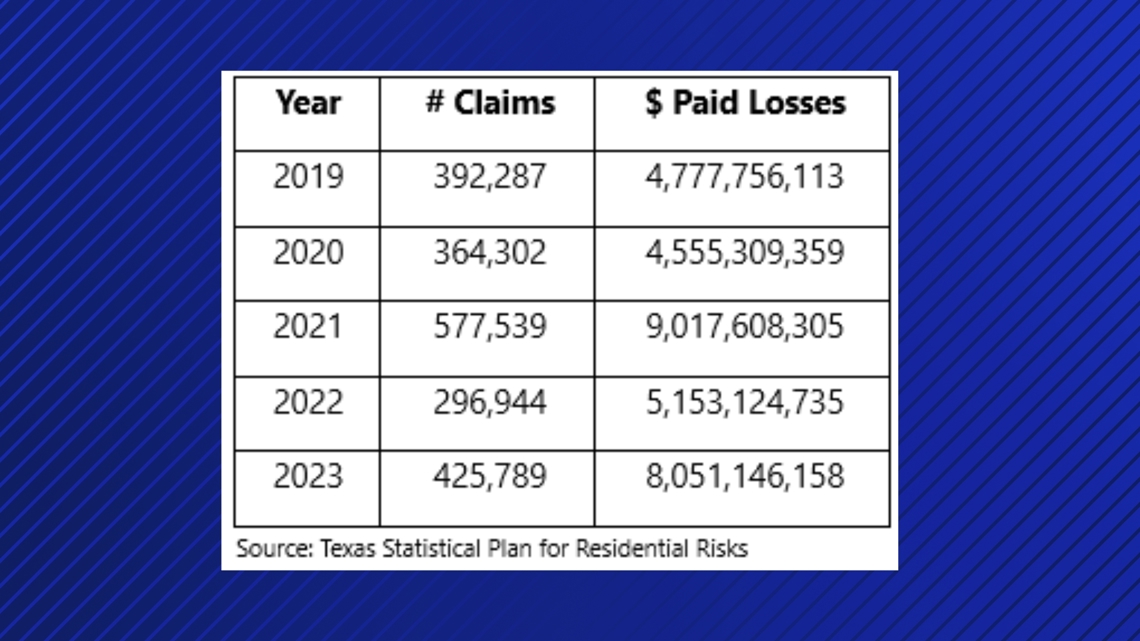

This table shows claims and paid losses for wind, hail, water and freeze damage for owner-occupied home insurance policies:

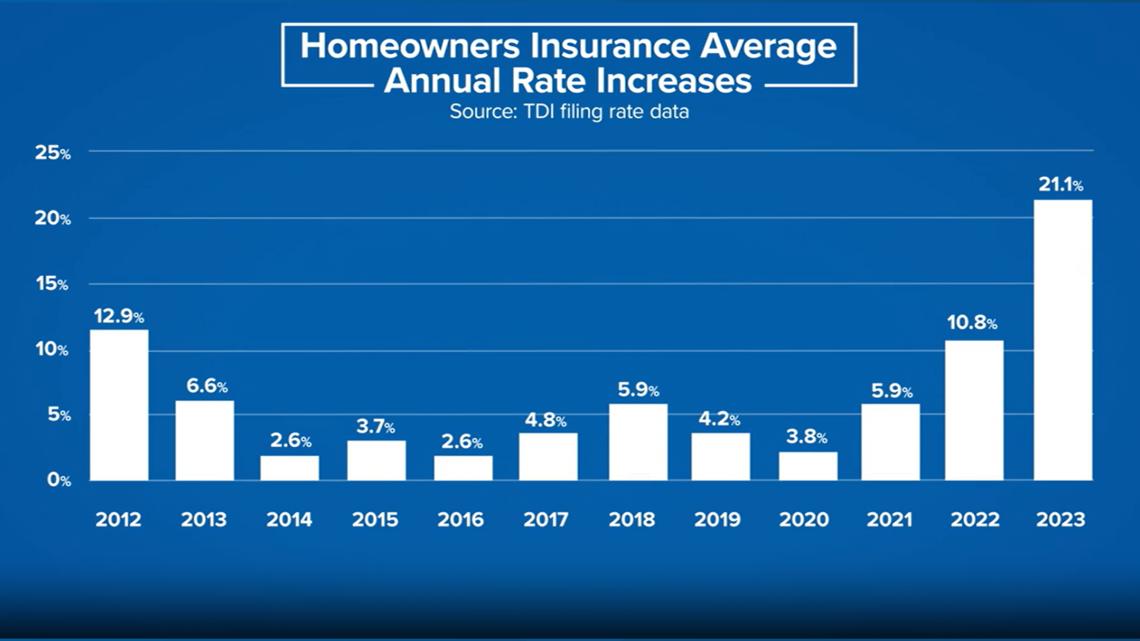

Data from the Texas Department of Insurance shows the average homeowner’s insurance rate jumped just over 21% in 2023. That’s more than double the yearly increases during the previous decade.

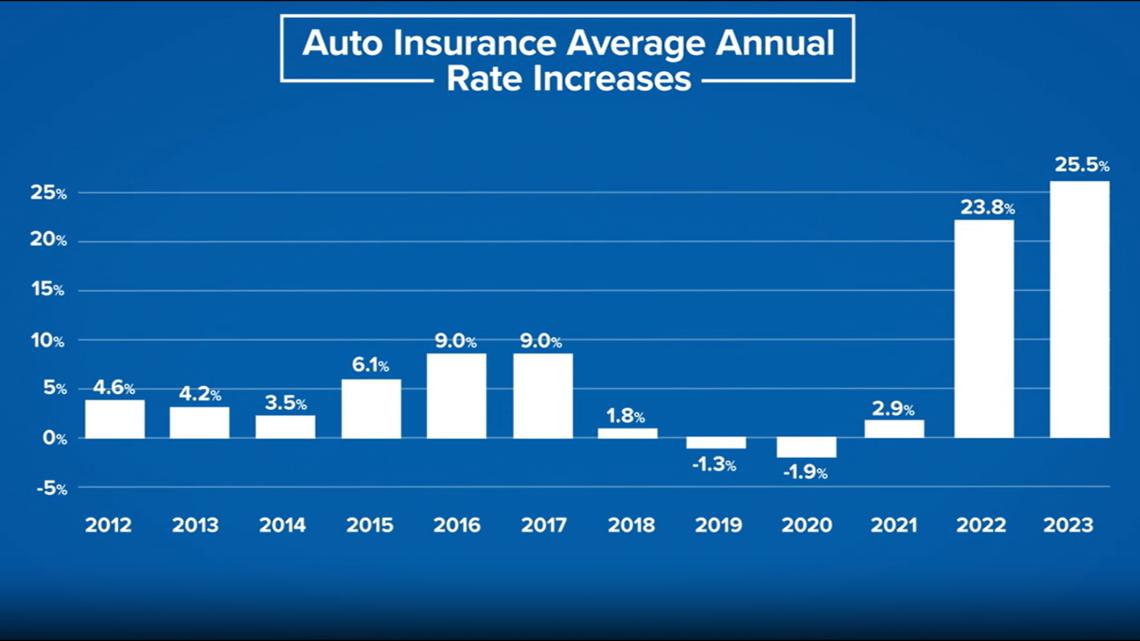

The TDI data shows the average auto insurance rate jumped more than 25% in 2023 after a nearly 24% jump in 2022.

Then there are the customers who got dropped. In 2023, insurance companies chose not to renew policies for about 138,000 home insurance customers and about 101,500 auto insurance customers.

Three insurance companies have left Texas entirely. Five other companies have stopped writing home insurance policies only, while six other companies have stopped writing just auto policies.

TDI told KVUE about 160 companies are still writing home insurance coverage in Texas, while about 170 offer personal auto insurance.

“It’s not that companies are pulling out,” said Rich Johnson, Director of Communications for the Insurance Council of Texas. “They may be changing coverages. They may be changing deductibles.”

ICT is with the state’s insurance trade organization.

Johnson says higher home and car values, pricier parts and labor, and more frequent and severe weather events are driving up costs.

“The more claims that an insurance company is paying out, the more that they do have to recover down the road,” said Johnson.

For auto specifically, Johnson says more frequent and severe crashes post-pandemic, plus lawsuits, are also raising rates in Texas.

“We’re number one in what we call ‘nuclear verdicts’, which are those verdicts that are $5 million or more,” said Johnson. “We do need to look at lawsuit reform.”

Then there are higher costs for reinsurance, or insurance for insurance companies, which is tied into the global market.

“I just don’t see magic bullets, and I wish I did because it would be great for everybody,” said David Buldoc, Public Counsel at the Office of Public Insurance Counsel.

Buldoc was appointed by Gov. Greg Abbott to represent the interests of Texas insurance customers.

“I think the biggest thing is to try to keep things as transparent as possible so people can shop as intelligently as possible,” said Buldoc.

Buldoc says that includes pushing insurers for contract clarity, along with consumer outreach to help Texans navigate a tough market.

“That boils down to comparing policies, shopping, being careful about what you buy, and making intelligent decisions about the amount of risk you’re willing to absorb yourself,” said Buldoc.

KVUE asked Buldoc for his message to frustrated Texans.

“I think the message really is, just, it’s a problem that you’re gonna have to deal with for the foreseeable future, at least the next few years,” said Buldoc. “It looks like it might moderate, but who knows? It depends on a lot of factors.”

In October, Buldoc and TDI Commissioner Cassie Brown testified before the Texas Senate Business and Commerce Committee.

Brown told lawmakers eight insurance companies have been approved to enter the Texas market, with 18 more pending.

“Between property taxes and insurance, it is the number one issue in our office,” Senator Lois Kolkhorst (R-Brenham) told them.

Members of the committee brainstormed solutions.

“I think it would be great to think of a way to create an insurance pool for uninsured motorists through registration,” said Sen. José Menéndez (D-San Antonio).

Two ideas came up repeatedly: ending the file-and-use system, which lets insurance companies charge higher rates before getting TDI approval and standardizing insurance forms.

“Those consumers could compare apples to apples and figure out which company’s offering them the best deal,” said Ware Wendell, Executive Director of Texas Watch, a nonpartisan citizen advocacy organization.

Texas Watch supports both changes.

“We want to make sure that we’ve got a more efficient system that protects those consumers and stops those overcharges before they happen,” said Wendell.

Wendell says Texans are paying more than twice the national average for home and auto insurance while receiving increasingly less coverage.

Texas Watch is also pushing for more options for drivers disputing repair costs while pushing Texans to contact their lawmakers.

KVUE asked Greg Banta if he had a message for lawmakers.

“You need to take a look at everybody across the board,” Banta replied.

Banta said the insurance hikes are affecting everybody and penalizing people playing by the rules.

“You’re taking a bite out of each and every one of us,” he said. “Hopefully things will change. I hope things get better. You can only hope.”

While lawmakers search for solutions, experts say the burden is largely on the consumer to find the best deal.

Their top recommendation: shop around. TDI and OPIC run HelpInsure.com to help consumers compare policies from home and auto insurers ranked by market share.

Other suggestions by the experts and advocates include:

- Work with an independent agent who works with many different insurance companies to find the best deal.

- Raise your deductible or change your coverage type based on your needs.

- Look for discounts from affiliations like military, first responders, or alumni groups. There are also student discounts for good grades.

- Pay out of pocket when possible, rather than file smaller claims.

- Consider climate risk when choosing where to live.

- Mitigate risk when possible against severe weather. For example, when replacing a roof, choose a reinforced roof that can survive a hailstorm.